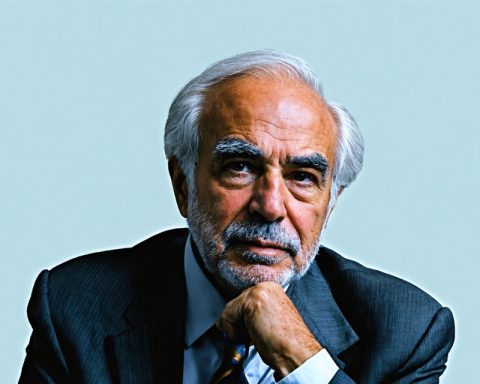

- Carl Icahn is a renowned figure in corporate America, known for his audacious strategies as a corporate raider.

- His career began with a successful investment in Tappan and was marked by transformative moves like restructuring Trans World Airlines (TWA) in the 1980s.

- Icahn is celebrated for his impact on major companies such as Apple and eBay, where he enhanced shareholder value and fostered growth through strategic changes.

- His career has not been free of setbacks, experiencing significant losses with Hertz and facing accusations of financial overvaluation in 2023.

- The core of Icahn’s investment strategy is a contrarian approach—seeing potential in distressed companies and acting decisively.

- Icahn’s journey illustrates the importance of boldness, informed decisions, and the willingness to seize overlooked opportunities.

In the tumultuous world of Wall Street, few names evoke as much awe and intrigue as Carl Icahn. Famous for his bold tactics and unyielding drive, Icahn is known as a quintessential corporate raider who reshaped the landscape of corporate America. His journey began in the late 1970s with a shrewd investment in Tappan, which catapulted him to fame and set the stage for his legendary career.

Picture this: Icahn, with his penetrating gaze, spots underperforming companies like a hawk. Over the years, his modus operandi has been consistent—swoop in, acquire a stake, and shake things up. The key to his success lies in seeing potential where others see problems. This is precisely what happened with Trans World Airlines (TWA) in the 1980s, where Icahn dismantled and restructured parts of the company, turning seeming chaos into opportunity. Although criticized, his methods laid bare the profit potential of strategic asset liquidation.

Icahn’s track record glistens with victories that reinforced his status. It’s hard to ignore the impact he made on heavyweights like Apple and eBay. Through relentless activism, he nudged Apple into a massive buyback program, enhancing shareholder value considerably. With eBay, his insistence on spinning off PayPal unleashed growth for both companies and rippled across the industry.

But Icahn’s career isn’t without blemishes. His substantial losses during the Hertz bankruptcy—a staggering $1.8 billion—served as a somber reminder of the inherent risks of high-stakes investment plays. More turbulent waters surfaced in 2023 when Hindenburg Research cast a shadow over his company, alleging overvaluation and risky financial practices. The accusations led to a precipitous fall in Icahn Enterprises’ stock, echoing the volatile nature of the finance world.

Still, undeterred by setbacks, Icahn’s spirit remains indomitable. His approach to investing offers a treasure trove of insights for aspiring investors. Fundamental to his strategy is a contrarian view—where Icahn sees opportunities, others see distress. It’s about digging deep, understanding a business beyond surface metrics, and acting decisively when the moment is ripe, much like an artist boldly sculpting from marble.

One might draw parallels between Icahn and Warren Buffett; both legends, yet their philosophies diverge in critical areas. While Buffett embraces management quality and is content to hold onto stocks indefinitely, Icahn is willing to get his hands dirty with underperforming businesses if their intrinsic values sparkle beneath the grime.

For those daring enough to emulate Icahn’s path, the key takeaway is clear: be bold, be informed, and above all, be ready to act when others hesitate. Icahn’s journey isn’t just about financial conquest; it’s about daring to see—and seize—possibilities others overlook.

You Won’t Believe What This Corporate Raider Did to Transform Wall Street!

The Legend of Carl Icahn: Lessons and Insights Beyond the Headlines

Introduction

In the relentless arena of Wall Street, Carl Icahn stands as a towering figure whose influence reshaped corporate America. Known as both a ruthless corporate raider and an astute activist investor, Icahn’s tactics and strategies offer invaluable lessons. His iconic journey began with a pivotal investment in Tappan in the 1970s, paving the path for his legacy. However, beyond the headlines, there are deeper insights and lessons to uncover.

How-To Steps & Life Hacks: Becoming a Fearless Investor Like Icahn

1. Spot Underperformance: Learn to identify companies with undervalued assets or potential for turnaround. Icahn’s investment in Trans World Airlines is a prime example of seeing opportunities where others saw failure.

2. Leverage Activist Strategies: Use stakes in companies to influence strategic decisions, like Icahn’s drive for Apple’s stock buyback and PayPal’s spin-off from eBay.

3. Embrace Risk Wisely: While Icahn’s successes are legendary, his $1.8 billion loss with Hertz highlights the importance of managing risks.

Real-World Use Cases

Icahn’s involvement with companies like Apple and eBay demonstrates the transformative power of strategic investments. His call for Apple’s stock buyback program added value for shareholders, showing the impact of applying pressure for company policy changes.

Market Forecasts & Industry Trends

Icahn’s strategies forecast a continued rise in activist investing, where investors seek to influence company management directly. The trend towards strategic asset sales, a hallmark of Icahn’s methodology, is likely to gain further traction as companies streamline operations to enhance shareholder value.

Controversies & Limitations

Despite Icahn’s success, his approach isn’t without controversy. Critics argue that his methods, such as asset liquidation, can prioritize short-term gains over long-term stability. The 2023 scrutiny by Hindenburg Research highlighted potential overvaluation concerns, emphasizing the need for due diligence.

Features, Specs & Pricing

Icahn Enterprises serves as a vehicle for his investment activities. Investors should evaluate its financial health, especially after recent controversies, to gauge intrinsic value.

Security & Sustainability

Activist investing poses inherent risks, and sustainability should be assessed alongside potential returns. Investors should consider the environmental, social, and governance (ESG) factors which are increasingly important in evaluating long-term value.

FAQs: Pressing Questions About Carl Icahn’s Approach

– What differentiates Icahn’s strategy from Warren Buffett’s?

Icahn actively engages in restructuring, often opting for a shorter-term turnaround, whereas Buffett follows a long-term buy-and-hold strategy with a focus on management quality.

– How does Icahn manage risk?

Icahn employs thorough research and a contrarian outlook but also accepts that high returns often involve significant risks, as seen in the Hertz bankruptcy.

Actionable Recommendations

For aspiring investors, the following tips can provide guidance based on Icahn’s strategies:

– Research Deeply: Go beyond surface metrics to uncover a company’s intrinsic value.

– Be Bold: Make informed, decisive moves and be prepared for both success and setbacks.

– Stay Informed: Keep abreast of market trends and potential investment opportunities.

For more insights into the world of finance and investment, explore resources from Bloomberg.

Icahn’s tale is not just about profits; it’s a testament to the power of bold decision-making and the willingness to see opportunities where others see obstacles. By understanding his approach, investors can glean strategies to navigate their paths in the financial world.