- The AI sector sees a fierce competition between industry giants Nvidia and AMD, each battling for market supremacy.

- Nvidia boasts a commanding market cap of $2.8 trillion, reflecting its dominance in the GPU and AI chip markets.

- Despite a 15% stock decline, Nvidia reports $72.9 billion in profits over the last four quarters, highlighting strong profitability.

- AMD, with a market cap of $165 billion, aims to capture significant AI market share, though it faces challenges with a 6% profit margin.

- Nvidia’s strategic innovation in AI technology keeps it ahead, while AMD seeks to increase its footprint with improved financial returns.

- Nvidia’s stock has seen a 29% increase over the past year, contrasting AMD’s 33% decline, underscoring Nvidia’s stronger market position.

- For investors, Nvidia offers a more reliable option given its profitability and leadership in AI advancements.

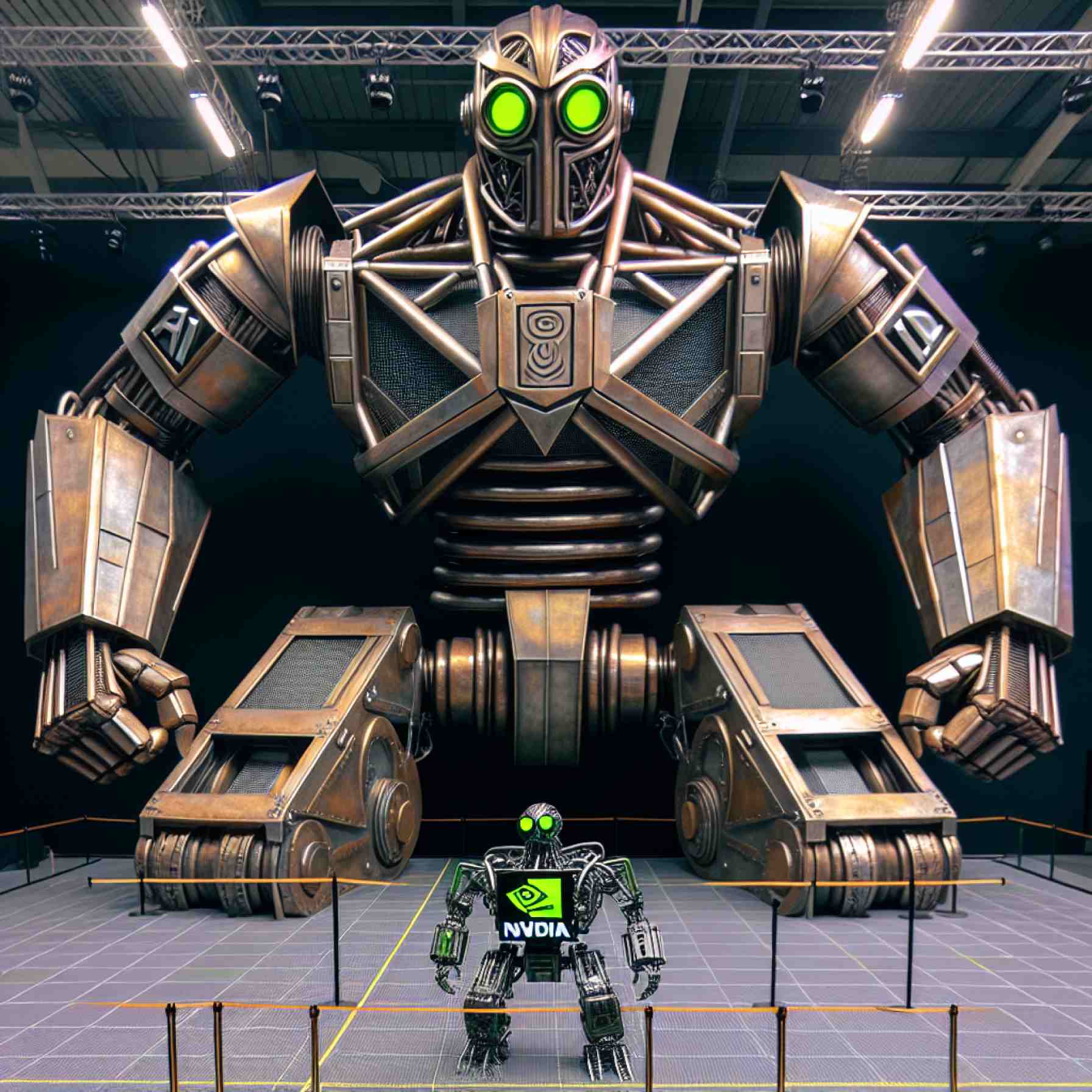

Crackling with the energy of burgeoning innovation, the race in the artificial intelligence (AI) arena is as fierce as ever. The tech universe, with its pulsating heart of silicon chips, sees two titans locked in a battle for supremacy: Nvidia and Advanced Micro Devices (AMD). The question darting through the minds of investors and tech enthusiasts alike is which entity holds the upper hand amid a slight cooling in AI enthusiasm.

Picture two giants standing back-to-back, one slightly taller, reaching for the clouds with a market cap still hovering near an astronomical $2.8 trillion. This is Nvidia, a company whose roots stretch deep into the earth of the graphics processing unit (GPU) market but whose branches are now laden with the golden fruits of AI potential. Despite a modest 15% decline this year—a figure that whispers of a broader market cool-off—Nvidia’s fiscal records shimmer with a robust $72.9 billion in profit over its last four quarters, imbuing it with an aura of invincibility.

Down the same path but with smaller but nimble steps, AMD trots along. A market cap of around $165 billion marks it as significant, yet a distant second to its rival. AMD’s roadmap is peppered with aspirations, including CEO Lisa Su’s bold predictions of reaping “tens of billions” from AI endeavors. However, these dreams are tempered by the stark reality of a more meager 6% profit margin—an Achilles’ heel in the gladiatorial AI market.

What drives Nvidia’s dominance is not just its historical victories but its strategic foresight. With a relentless drive, it consistently launches cutting-edge AI chip technologies, slicing through industry challenges with precision. While its counterpart, AMD, attempts to carve a niche in this AI-dominated landscape, it faces the Herculean task of proving its AI chips can challenge Nvidia’s high-market leaders.

Both stocks find themselves entangled in the delicate dance of market performance, with Nvidia showing a reassuring 29% uptick over the last twelve months against AMD’s contrasting 33% drop. This past performance serves as both a warning and an invitation. For AMD, the path forward demands more than just aspirations; it requires tangible improvements in operational efficiency and financial returns.

The financial tableau paints a vivid picture: Nvidia’s lower price-to-earnings ratio is a testament to its seasoned profitability and a hallmark of a veteran champion in this technological epoch. The key takeaway is clear: while AMD’s narrative is one of potential, of what could be, Nvidia tells a story of presence, of what is now—a company steady in its stride, firmly planted in the fertile soil of current technology leadership, ready to bear more fruit.

For investors pondering their next move in the thriving AI sector, Nvidia presents a more secure, promising avenue. With its established market presence and track record of innovation, Nvidia’s path shines brightly, beckoning those who dare to dream, grounded in the reality of formidable market leadership.

Nvidia vs. AMD in the AI Arena: Who Will Win the AI Chip Battle?

Understanding Nvidia’s Stronghold and AMD’s Ambitions in the AI Chip Industry

In the world of artificial intelligence (AI) and cutting-edge technology, the rivalry between Nvidia and Advanced Micro Devices (AMD) intensifies as both companies push the boundaries in AI chip development. While Nvidia continues to lead with superior financial performance and innovative prowess, AMD strives to compete by carving out its niche and scaling its AI capabilities. This detailed exploration offers insights into their strategies, market dynamics, and what the future holds for these giants.

How Nvidia Maintains Its Lead

1. Market Dominance:

– Nvidia’s substantial market cap, hovering around $2.8 trillion, highlights its dominance in the tech sector. This leadership position is reinforced by a robust $72.9 billion profit over the past four quarters.

2. Cutting-edge Innovations:

– Renowned for groundbreaking advancements in AI chip technology, Nvidia’s GPUs remain the gold standard thanks to their efficiency and high performance. These innovations are critical in sectors like autonomous vehicles, data centers, and gaming.

3. Strategic Partnerships and Ecosystem:

– Nvidia’s robust ecosystem, bolstered by partnerships with tech giants and startups, furthers its reach into new AI applications and strengthens its market grip Learn more.

4. Strong Financials and Investor Confidence:

– A lower price-to-earnings ratio coupled with consistent revenue growth positions Nvidia as a stable investment opportunity, showcasing resilience even in fluctuating market conditions.

AMD’s Aspiring Journey in AI

1. Growth Potential and R&D Investments:

– AMD, with a market cap of approximately $165 billion, is investing aggressively in R&D to enhance its AI offerings. While its profit margins lag behind, the company is betting on future growth, particularly through its strategic acquisitions and next-gen AI chips development Discover more.

2. CEO’s Vision and Strategic Direction:

– Under CEO Lisa Su, AMD aims to capture “tens of billions” from AI ventures. This vision is geared towards diversifying the AI field with alternatives to Nvidia’s dominance.

3. Recent Performance and Future Roadmap:

– AMD has seen a 33% drop in stock performance recently, emphasizing the need for operational efficiency and enhanced financial returns to actualize its ambitious AI targets.

Pressing Questions and Insights

– Who Offers More Value to Investors?

– Nvidia’s established market presence and continuous innovation make it a safer bet for risk-averse investors. Meanwhile, AMD presents a high-risk, high-reward scenario for those banking on its projected AI triumphs.

– How Sustainable is Nvidia’s Advantage?

– Nvidia enjoys considerable first-mover advantages; however, sustainability hinges on maintaining tech leadership and adapting to rapid industry shifts amid growing competition.

Industry Trends and Predictions

– AI Integration Across Sectors:

– AI isn’t limited to tech-centric uses; it’s extensively being integrated into industries like healthcare, finance, and manufacturing, creating lucrative opportunities for AI chip makers.

– Emerging Competitors:

– The field is expanding as new players enter with specialized offerings, which could dilute the market share of traditional giants like Nvidia and AMD unless they remain agile and innovative.

Actionable Recommendations

– For Nvidia:

– Continue expanding AI application areas, focus on sustainable and energy-efficient technologies, and increase collaborations.

– For AMD:

– Prioritize refining operational efficiency, amplifying R&D to innovate unique solutions, and build strategic partnerships to capture emerging market segments.

By understanding the current landscape and keeping an eye on tech advancements, stakeholders can make informed decisions that align with their investment strategies and technological interests. To explore more about Nvidia’s and AMD’s offerings, visit their official sites: Nvidia and AMD.

The AI chip arena’s future is vibrant and evolving, with opportunities and challenges that require strategic foresight and sustained innovation efforts from all players involved.