- Eos Energy Enterprises, based in Edison, NJ, is leading the charge in sustainable energy with zinc-based long-duration storage systems.

- Q4 earnings report shows a significant 10% year-over-year revenue increase, totaling $7.3 million, despite a reported net loss of $268.1 million due to stock-related non-cash adjustments.

- Eos is proactively expanding its capabilities with the new Factory 2 Works and additional manufacturing lines to meet growing demand.

- The company secured a $303.5 million loan from the U.S. Department of Energy, underpinning its strong financial position.

- Strategic partnerships, such as with Cerberus Capital Management, highlight Eos’s intent to enhance production and innovate further.

- Eos projects revenue growth between $150 million and $190 million by 2025, driven by increased production and technological investments.

- Eos Energy Enterprises represents a pivotal force in the evolution of renewable energy, demonstrating the power of innovation and strategic foresight.

The vast plains of Edison, New Jersey, house an unlikely architect of the future—Eos Energy Enterprises. While the world grapples with a pressing need for sustainable energy solutions, this cutting-edge company emerges as a luminary, lighting the path toward a greener tomorrow. Specializing in zinc-based long-duration energy storage systems, Eos isn’t just playing the game; it’s redefining the rules.

Recently, Eos unveiled their Q4 earnings report, a vibrant tapestry of success interwoven with ambition. The report reveals a remarkable 10% year-over-year revenue increase, rocketing 749% from the preceding quarter to a striking $7.3 million. Yet, these figures merely lay the foundation of a much grander narrative. Despite a reported net loss of $268.1 million, attributed mostly to non-cash adjustments stemming from stock price volatility, Eos’s overarching growth strategy remains clear.

The true story lies not only in numbers but in the audacious strides Eos is making to electrify its future. By expanding operational capabilities—a move heralded both by the unveiling of their new Factory 2 Works and additional manufacturing lines—the company is poised to meet burgeoning demand head-on. Backed by robust financial muscle, fortified by a $303.5 million loan secured with the blessing of the U.S. Department of Energy, Eos marches into the future with confidence, guided by both innovation and strategic foresight.

According to the report, investments and partnerships spell out a promising trajectory. Eos has orchestrated pivotal alliances, notably with Cerberus Capital Management, suggesting a bold intent to bolster production while pushing the envelope of what’s possible in energy storage. Their commercial pipeline teems with opportunity, supported by a mounting orders backlog, confirming the market’s insatiable appetite for Eos’s pioneering solutions.

Gazing forward, Eos underscores its vision with daring projections—an anticipated surge in revenue, forecasted to range between $150 million and $190 million by 2025. This is not mere optimism but a calculated anticipation underpinned by expanding production capabilities and visionary investments in technology and infrastructure.

The key takeaway echoes with resonant clarity: Eos Energy Enterprises embodies the innovation and tenacity vital for crafting a sustainable future. As the global embrace of renewable energy tightens, Eos steps boldly onto the stage, not merely as a participant but as a decisive player directing a transformative narrative. Their journey serves as an electrifying testament to what’s achievable when innovation meets purpose, heralding a new chapter in the story of energy.

Is Eos Energy Enterprises Leading the Future of Sustainable Energy?

Unpacking Eos Energy Enterprises’ Innovative Approach

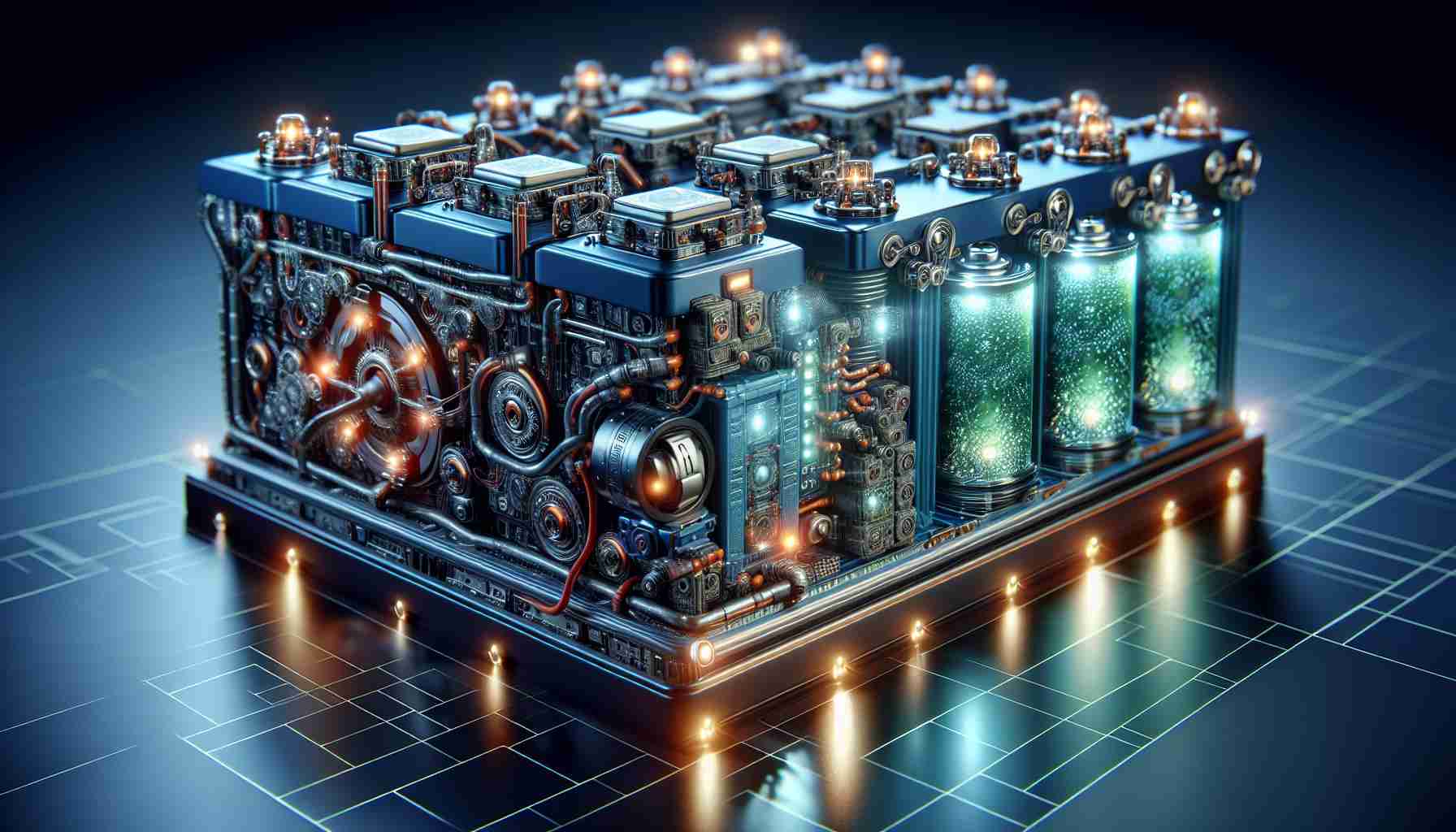

Breaking Down Eos’s Zinc-Based Technology

Eos Energy Enterprises has positioned itself as a trailblazer in the energy sector, thanks to its innovative zinc-based long-duration energy storage systems. This technology has several key advantages over traditional lithium-ion storage systems, offering enhancements in safety, cost-effectiveness, and sustainability. Zinc batteries do not rely on scarce materials like cobalt and nickel, making them a more environmentally friendly option.

Why Zinc-Based Systems Matter

1. Safety: Zinc-based batteries are non-flammable, reducing the risk of fires—a significant concern with lithium-ion systems.

2. Durability: They boast a longer life cycle, which equates to more cycles before replacement, translating to lower long-term costs.

3. Sustainability: Zinc is more abundant and recyclable than many components in lithium-ion batteries, reducing environmental impact.

Market Trends and Future Growth

Advanced Energy Storage Market Outlook

The energy storage market is on the cusp of rapid expansion, driven by the urgent global need for renewable solutions. According to research, this market is expected to grow from $15 billion in 2020 to over $100 billion by 2030, with zinc-based solutions playing a critical role.

Investments and Partnerships: Strategic Moves

Eos’s financial strategies, including their partnership with Cerberus Capital Management, indicate a vigorous push towards expanding production capabilities. These partnerships not only provide the capital needed for growth but also bring in strategic expertise and insights that can guide technological advancements and market penetration.

Pressing Questions and Expert Insights

What Sets Eos Apart from Competitors?

Eos Energy differentiates itself through its focus on zinc technology, a strategic choice that aligns with growing environmental consciousness and regulatory pushes for greener solutions. Their U.S. Department of Energy-backed loan underscores the government’s confidence in their technology, offering a competitive edge.

Financial Health: Managing Losses and Strategizing for Growth

Despite reporting a loss primarily due to non-cash stock adjustments, Eos’s strategic investments in Factory 2 Works and expanded manufacturing facilities demonstrate a future-focused approach. As they aim to ramp up production, the expectation of $150-$190 million revenue by 2025 seems well within grasp if current trends continue.

Implementable Strategies and Quick Tips

1. Stakeholder Engagement: Engage with renewable energy advocates and policy-makers to fuel support and awareness of zinc-based technologies.

2. Diversification and Risk Management: While pioneering in zinc technology, exploring complementary avenues in energy can safeguard against market fluctuations.

3. Customer Education: Invest in educational initiatives to inform potential customers about the advantages of zinc-based storage solutions over traditional systems.

Conclusion

Eos Energy Enterprises exemplifies how bold innovation married with strategic foresight can forge a sustainable path in the ever-evolving energy landscape. As they scale up, the company embodies the potential that sustainable energy solutions hold, illuminating prospects for a greener future. Whether you’re an investor, policymaker, or an enthusiast, keeping an eye on Eos’s story could provide valuable insights into the energy trends of tomorrow.

For more information about innovations in sustainable energy, visit EOS Energy Enterprises.